Guide on how to make adjustment on tax when total tax amount from original invoice (document) and calculation from Xero are not tally.

Total tax amount calculate by Xero and Total Tax amount from your original invoice may be different. This discrepancy may happened because Xero calculates tax on a line by line basis, so you may need to make an adjustment to match tax calculated on the transaction total.

*Please note that ASSIST applies the result based on tax calculation from Xero.

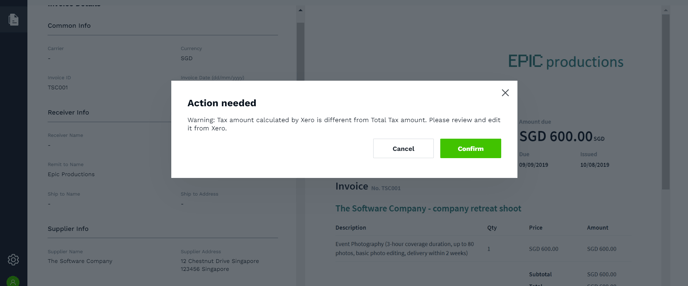

You will see the pop-up message from ASSIST when you click on "Send to Xero", for your acknowledgement that tax is not tally.

Please click on "Confirm" to send the invoice to Xero, if you still would like to proceed. After sending the documents to Xero, please make adjustment on Tax amount directly from Xero.

You may refer to the article below from Xero to follow their procedure to adjust the tax amount.